Analyst Gerhard from Bitcoin Strategy predicts Render (RNDR) will keep pumping based on its current dynamics.

In a detailed comparison with Ethereum (ETH), the expert analyzed Render’s relative performance and assessed the impact of token inflation on the cryptocurrency’s value, which has been positive for the token. Gerhard states that customer demand, as evidenced by token balances on Binance and OKX, has been a primary driver of Render’s market movement, suggesting potential future growth as token inflation decreases. This comes as AI tokens lead the current cycle.

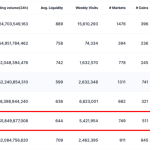

Further exploration into the Render ecosystem revealed a consistent token accumulation across Ethereum (ETH) and Polygon (MATIC) networks. The analyst states that approximately 10,000 Render wallets hold over $100,000, while over 22,000 holders store their tokens on Polygon. Despite this, most of the token’s capital remains on Ethereum, which recently advanced to an AI-backed L2 network, signifying a higher level of trust in this network.

The data suggests that retail investors and whales are accumulating Render, as also previously seen in February, indicating strong interest across different investor segments. However, the speaker cautioned about the risk of a potential slowdown in the altcoin market due to a possible lack of new capital inflow. While Render’s recent performance appears promising, he states that the broader market sentiment could influence its trajectory. Despite these potential headwinds, the expert remains optimistic.

Render Price Review: How is RNDR Doing in Today’s Session?

Analysing Render price charts, we see that the chart shows a consistent upward trajectory within a rising channel, which is a bullish pattern. The price movement has been maintaining the lower boundary of this channel, suggesting strong buying interest at these levels. Should we see a break below the channel’s lower boundary, we could likely see a pullback to previous support levels. On the other hand, should it break above the channel’s upper boundary, we could see further price pumps on the token.

2-hour RNDR/USD Chart | Source: TradingView

On the other hand, looking at technical indicators, we see that the Woodies CCI (Commodity Channel Index) is well above +100 for most of the time period shown, which indicates strong upward momentum. It is, however, essential to be cautious as such high levels can also hint at overbought conditions, which might lead to a pullback or consolidation. On the other hand, the MFI (Money Flow Index) is at 81.56, which is in the overbought territory (above 80). This suggests that the price might be at a point where a correction could occur due to fewer buyers willing to buy at a higher price. Based on stats from CoinMarketCap, we see that Render was trading at $11.53, representing a 12.6% increase over the last 24 hours.